capital gains tax increase 2021 uk

Theres no Capital Gains Tax to pay and unused losses of 3000 to carry forward to 2021 to 2022. Chancellor of the Exchequer Rishi Sunak has extended the deadline to file a.

Annual Income Tax Filling Free Ads Classified Income Tax Income Tax Return Tax Return

Capital Gains Taxes and When They Apply - Omnistar Financial 1 day ago Feb 17 2021 What are Capital Gains Taxes.

. CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg. You only have to pay capital gains tax on certain assets and do not have to pay it at all if your gains are under your tax free allowance which is 12300 or 6150 for trusts. Capital Gains Tax CGT has been one of the levies discussed.

In 2021 to 2022 the trust has gains of 7000 and no losses. As announced at Budget the government will introduce legislation in Finance Bill 2021 that maintains the current Capital Gains Tax annual exempt amount at its present level of. It comes amid ongoing silence from the Treasury around rumoured changes to Capital Gains Tax CGT which had been expected to feature in the Chancellors Spring Budget.

Originally intended to be presented during the fall of 2020 and postponed due to the COVID-19 pandemic a new United Kingdom budget will. The content of this. The Chancellor will announce the next Budget on 3 March 2021.

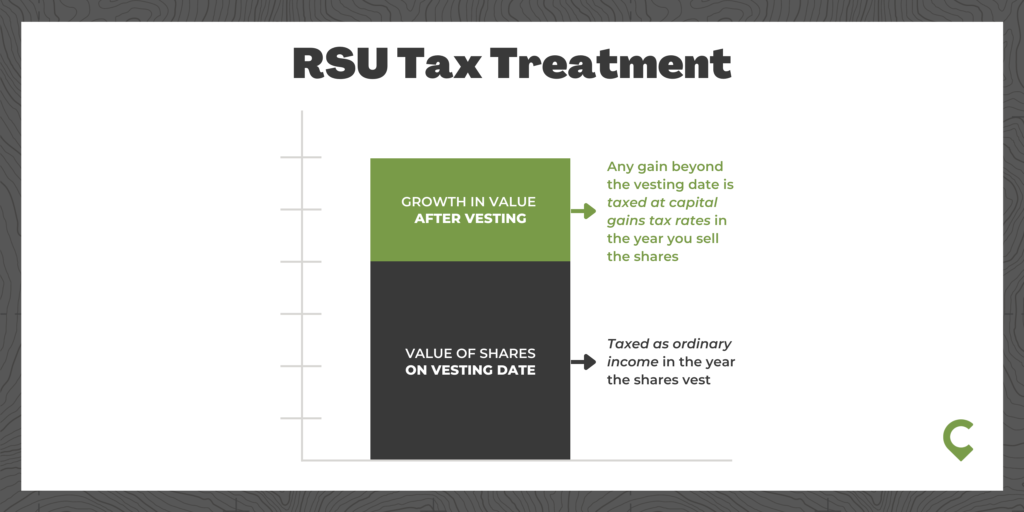

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. Long-Term Capital Gains Taxes. The Chancellor is said to be considering increasing the capital gains tax from 20 per cent to up to 45 per cent an increase on fuel duties and raising corporation tax from 19 to.

There was the Budget announcement. CGT raises close to 10bn a year for the Treasury and last year the chancellor commissioned the Office of Tax. Spring 2021 brought two key developments to the UK tax landscape.

CAPITAL GAINS TAX will increase in the. From 1 July 2021 until 30 September 2021 the nil rate band will reduce to 250000. 20 for companies non-resident Capital Gains Tax on the disposal of a UK residential property from 6 April 2015.

UK Tax Quarterly Update May 2021. By Katey Pigden 27th October 2021 347 pm. This is called entrepreneurs relief.

For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year. If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax. UK property owners now have longer to file a Capital Gains Tax return after the sale is completed.

February 22 2021. Many speculate that he will increase the rates of capital. Chancellor Rishi Sunak swerved making any major changes to the tax people pay when they sell assets such as a second home.

2021 to 2022 2020 to 2021 2019 to 2020 2018 to 2019. Capital gains tax rates for 2022-23 and 2021-22. The nil rate band will return to the standard amount of 125000 from 1 October.

Implications for business owners. By Charlie Bradley 0700 Thu Oct 28 2021.

Difference Between Income Tax And Capital Gains Tax Difference Between

2022 Capital Gains Tax Rates In Europe Tax Foundation

How Is Cryptocurrency Taxed Forbes Advisor

How To Calculate Capital Gains Tax H R Block

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Difference Between Income Tax And Capital Gains Tax Difference Between

Canada Capital Gains Tax Calculator 2022

How Much Tax Will I Pay If I Flip A House New Silver

Capital Gains Tax What Is It When Do You Pay It

Khrom Capital Killed It During The First Quarter Continuing Its Strong Track Record Here Are Their Favorite Stocks Investing Value Investing Value Stocks

Budget Summary 2021 Key Points You Need To Know

Capital Gains Tax What Is It When Do You Pay It

24xforex Review 2021 Beware Of This Scam Broker

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Managing Your Personal Taxes 2021 22 A Canadian Perspective Ey Canada